At DP Capital, your money doesn't get sick, retire, or die - it just keeps growing and working for generations. Let us show you how.

At DP Capital, we don’t wait for markets—we build secure, high-yield real estate investments for those ready to invest with purpose.

Alata

Alice

Open Sans

Noto Sans

Bebas Neue

Great Vibes

Rock Salt

Exo

Belgrano

Overlock

Cinzel

Indie Flower

Staatliches

Roboto Slab

Lato

Noto Serif

Open Sans

Montserrat

Ubuntu

Rubik

Delius

Amiri

Montserrat

Investment Opportunities

Debt Partnership

This is our most accessible and predictable investment option. As a debt partner, you lend capital to one of our real estate projects and earn 30 - 45% returns, typically over a 12- to 36-month term. Your investment is secured by the underlying asset, and we take full responsibility for the project’s execution.

Equity Partnership

As an equity partner, you become a co-owner in the deal. You share in the cash flow, appreciation, and profits from refinancing or sale. While equity investments involve more risk than debt, they also offer unlimited upside potential and long-term tax benefits.

Majority Equity Partnership

These are deals that fall just outside our institutional buy box—typically under $5 million—where we partner directly with individual investors who want majority ownership. You provide most of the equity; we bring the deal, execute the strategy, and manage everything from permitting to management to exit.

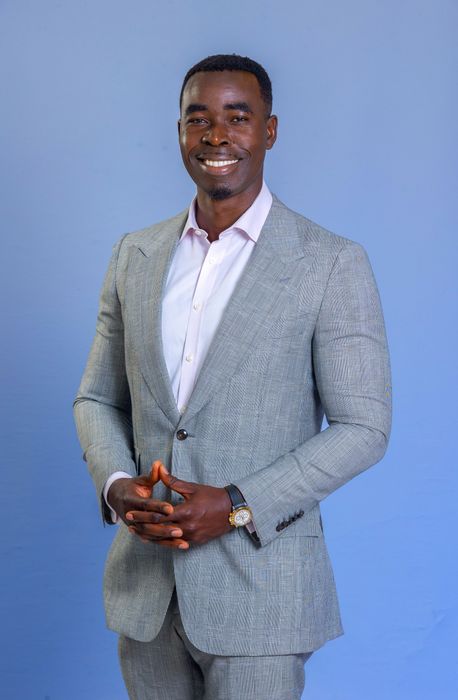

Dayo Adebayo

Founder

Dayo is a builder by instinct and an investor by discipline. With a background in business intelligence and enterprise consulting for Fortune 100 companies, Dayo left the corporate world to build something of his own—founding and scaling multiple businesses before turning his full focus to real estate. Today, he leads DP Capital Partners with one mission: to help investors grow lasting wealth through hands-on, real asset investments.

Dayo has successfully led over $100 million in real estate development and investment projects, specializing in high-traffic commercial properties—including storage facilities, hospitality assets, medical offices, and income-producing industrial spaces. He doesn’t just underwrite deals—he lives them. From managing engineers, architects and zoning approvals to stepping in as general contractor during a $6 million RV storage build, Dayo brings sweat equity and strategic oversight to every opportunity.

His approach is simple: identify undervalued assets, unlock their potential through active management, and deliver fixed, risk-adjusted returns backed by real property. With deep market knowledge in Atlanta and a flawless track record of protecting investor capital, Dayo blends Wall Street logic with Main Street execution. He invests his own money alongside every partner—because for him, it’s never just a deal. It’s a legacy.

From Fortune 100 Advisor to $100M+ Real Estate Developer

I’ve led over $100 million in real estate deals—without losing a single investor’s dollar. But I didn’t start with money, connections, or a roadmap. I built it piece by piece, and if I can do it, you can most definitely do it too. You just need the right guidance.

“How I Built a $100M Real Estate Portfolio—and How You Can Start Today”

Learn the exact strategy I use to find high-return deals, manage risk, and turn overlooked properties into generational wealth.